Boiler Upgrade Scheme (Heat Pump Subsidy)

Introduction

The Boiler Upgrade Scheme (BUS) supports the decarbonisation of heat in buildings. It provides upfront capital grants to support the installation of heat pumps and biomass boilers in homes and non-domestic buildings in England and Wales. Acting on behalf of property owners, installers can apply for £7,500 off the cost and installation of an air source heat pump.

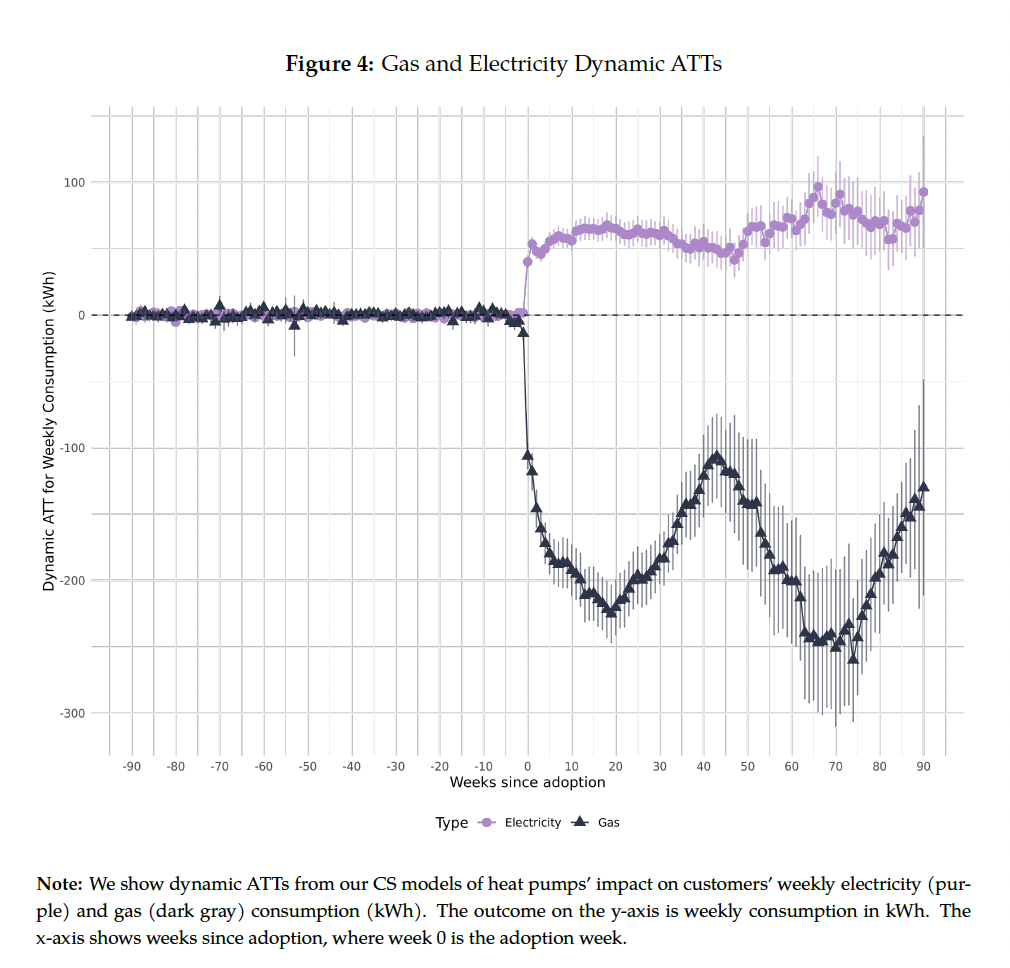

Bernard, Hacket, Metcalfe, and Schein (2024) estimates the causal impact of heat pumps on energy demand (with a sample of 1,321 heat pump adopting customers) and, separately, the impact of a time-of-use tariff designed for heat pump owners (with a sample of 6,631 time-of-use tariff adopting customers). In both cases, the paper employs a staggered difference-in-differences identification strategy, whereby everyone in the sample eventually adopts a heat pump (or the special time of use tariff) with the utility, but they do so at different times of the year due to the utility being unable to treat everyone (i.e., install heat pumps) at once. This natural experiment allows the paper to causally estimate the impact of heat pumps on electricity and gas demand, and the new heat pump time-of-use tariff on electricity demand, using actual consumption data from Octopus Energy consumers in Great Britain.

The paper uses this same natural experiment and a similar staggered difference-in-differences estimator to identify the impact of Octopus Energy’s new heat pump time-of-use tariff on energy demand.

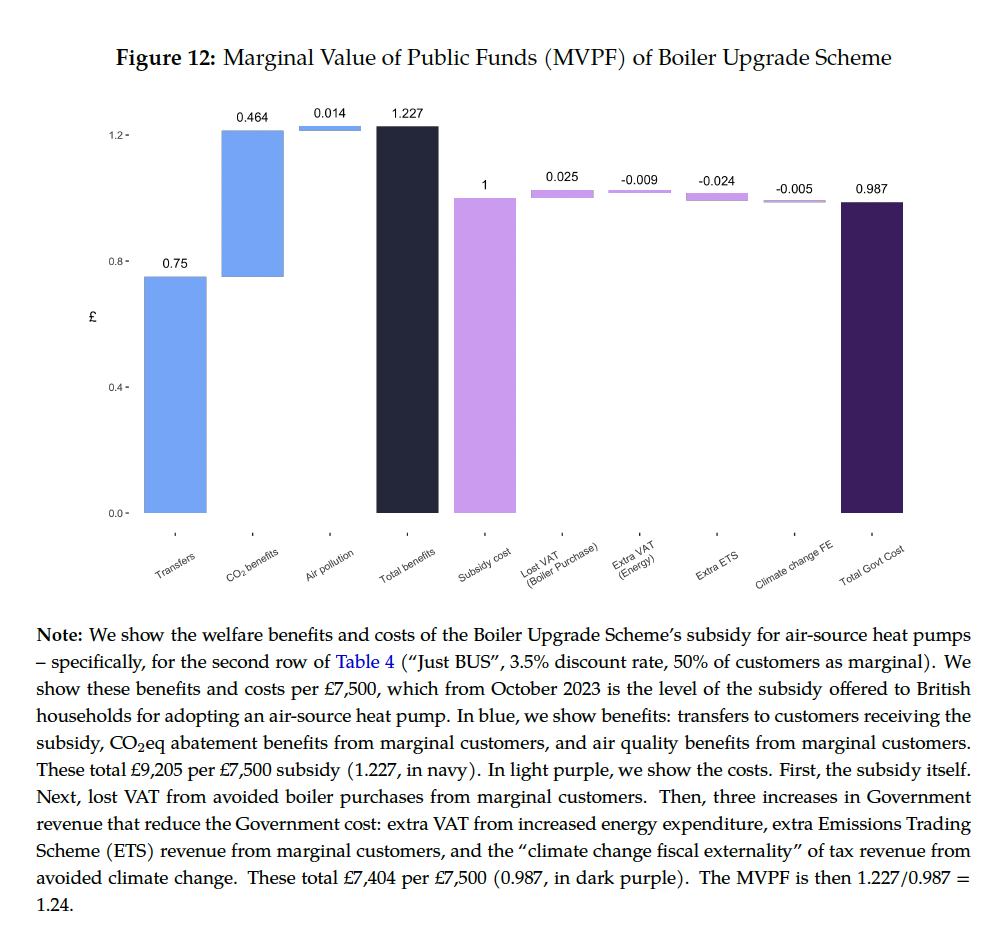

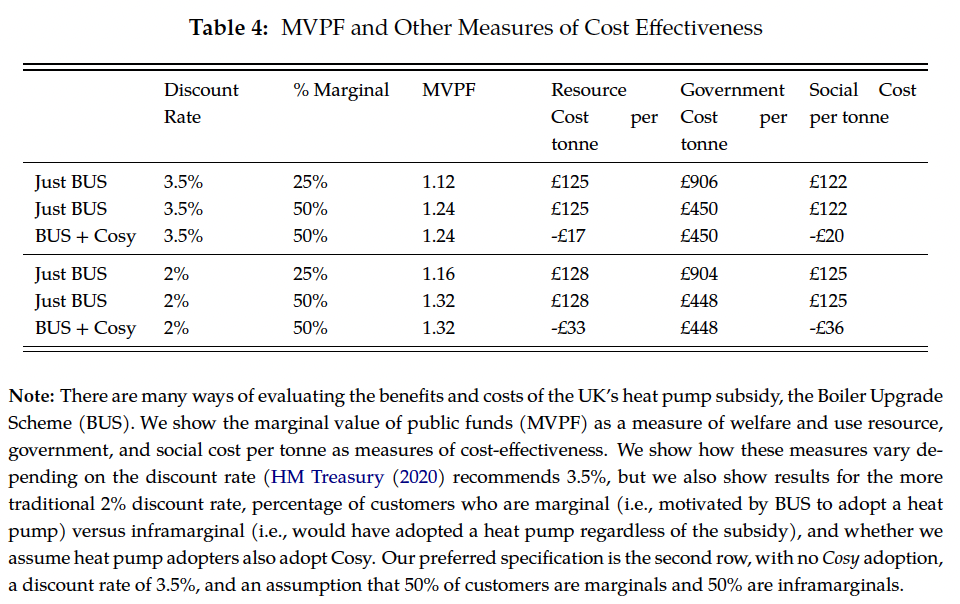

The paper uses the demand estimates from heat pumps and the time-of-use tariff to calculate the welfare changes of policies to encourage heat pump adoption – specifically, the Boiler Upgrade Scheme. The paper computes the marginal value of public funds (MVPF) (Hahn, Hendren, Metcalfe, and Sprung-Keyser 2024, Hendren and Sprung-Keyser 2020) for the heat pump subsidy in the UK (the Boiler Upgrade Scheme) to understand its efficiency.

MVPF = 1.2

Net Cost

The direct cost of the subsidy is £7,500.

The paper includes four fiscal externalities, calculated assuming that 50% of adopters are marginal. The additional Value Added Tax (VAT) accrued due to energy sales is £68, while the VAT lost due to reduced boiler purchases was £188. The paper also estimates the “climate change fiscal externality” of tax revenue from avoided climate change as £37 and the additional Emissions Trading Scheme (ETS) revenue as £177.

The total net cost is then £7,500 – £68 + £188 – £37 – £177 = £7,404.

Willingness to Pay

To calculate the willingness to pay, the paper assumes that 50% of adopters are marginal.

Under that assumption, the paper estimates the benefit from CO2 reductions as £3,477, the benefit from air pollution reduction as £103, and the value of the transfer at £5,625. This last value is 75% of £7,500 and based on the assumption that the latent value of the subsidy varies uniformly in the population, implying a linear demand curve.

The total estimated willingness to pay is then £3,477 + £103 + £5,625 = £9,205.

MVPF Summary

The MVPF of the Boiler Upgrade Scheme is then £9,205 / £7,404 = 1.24.

The paper includes MVPFs under alternative assumptions, including assuming 25% of adopters are marginal (instead of 50%), a 2% discount rate (rather than the 3.5% discount rate recommended by HM Treasury), and an MVPF estimate that includes the learning by doing benefits of the subsidy.

References

Bernard, Louise, Andy Hacket, Robert D. Metcalfe, and Andrew Schein (2024). “Decarbonizing Heat: The Impact of Heat Pumps and a Time-of-Use Heat Pump Tariff on Energy Demand.” NBER Working Paper 33036. https://www.nber.org/papers/w33036

Hahn, Robert W., Nathaniel Hendren, Robert D. Metcalfe, and Ben Sprung-Keyser (2024). “A Welfare Analysis of Policies Impacting Climate Change.” NBER Working Paper 32728. https://www.nber.org/papers/w32728

Hendren, Nathaniel and Ben Sprung-Keyser (2020). “A Unified Welfare Analysis of Government Policies.” The Quarterly Journal of Economics, 135(3): 1209–1318. DOI: https://doi.org/10.1093/qje/qjaa006

Policy Features

- Category

- Environment

- Sub-Category

- Environmental Subsidies

- Beneficiary Type(s)

- Adults, Children and Youth, Children under five

- Average Age

- 41

- Average Income

- 37000

- Country of Implementation

- United Kingdom

- Year of Implementation

- 2022

- Empirical Method

- Difference in Differences

- Research Type

- Primary

- Peer Reviewed

- No

- MVPF Publication Link

- www.nber.org/papers/w33036